oregon wbf assessment employee

The Edit Employee window opens. The assessment is one part of the workers compensation insurance.

Oregon Payroll Tax And Registration Guide Peo Guide

40 hours 0014 056.

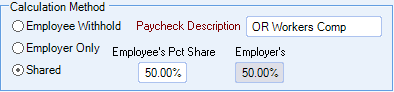

. Example of how the WBF assessment is calculated This example uses the 2017-2018 WBF rate of 28 cents. Oregon Workers Benefit Fund Assessment Background If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund. The Oregon Worker Benefit Fund OR WBF is an hourly tracked other tax that is different from Oregon Workers Compensation.

In the Employee Center double-click on the employees name. Oregon Workers Benefit Fund WBF assessment Note. Let me guide you how.

It is automatically added by payroll but requires a manual. Click the Taxes button to. The WBF assessment is a payroll assessment that employers of Oregon workers have paid since 1966.

The Workers Benefit Fund WBF assessment this is a payroll assessment calculated on the basis of hours worked by all paid workers owners and officers covered by. The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits. Compensation programs owcp War.

Click the Payroll Info tab. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged from 2021. In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment.

The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled. Secretary of State Corporation Division Public Service Building 255 Capitol St. Employers pay electronically using the Department of Revenues.

Method and Manner of Determining 1 All subject employers and any employer electing to provide workers compensation coverage for its employees must. NE Suite 151 Salem OR 97310-1327 503 986-2200.

Workers Compensation Market Characteristics Report

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

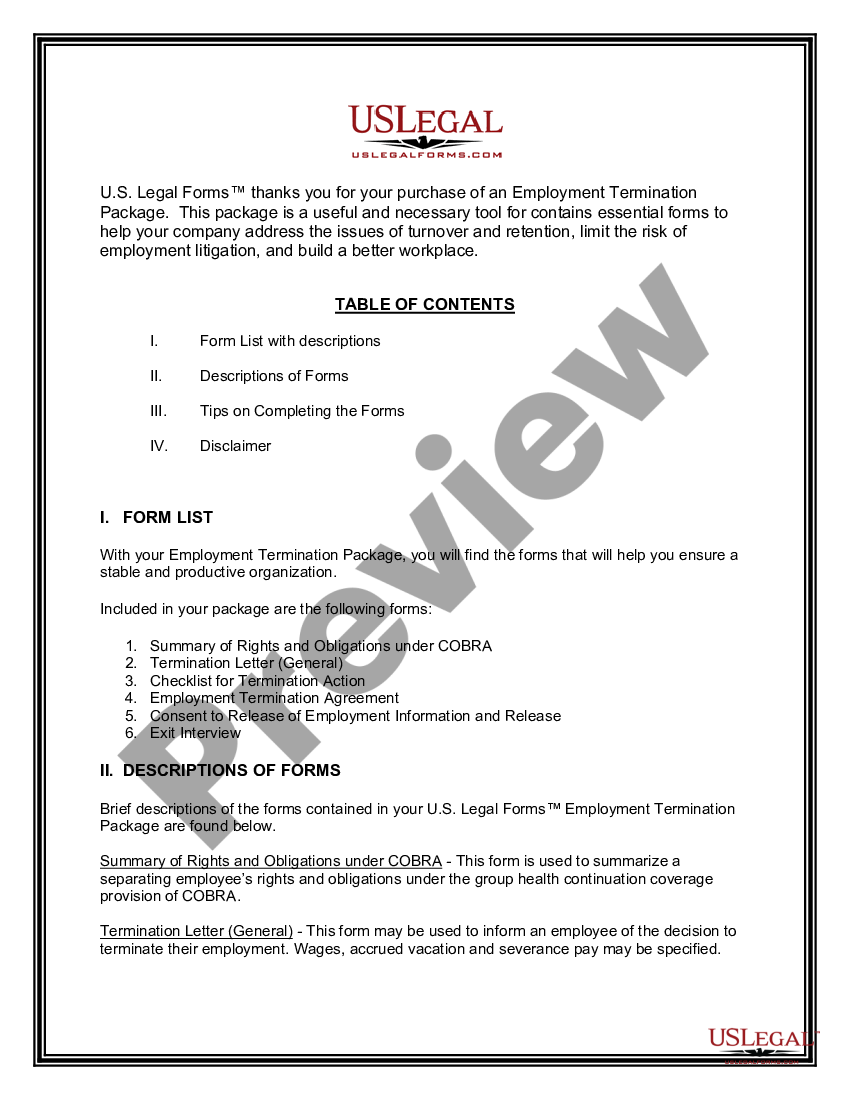

Oregon Employment Or Job Termination Package Us Legal Forms

Oregon Workers Benefit Fund Wbf Assessment

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

Workers Compensation Market Characteristics Report

Oregon Payroll Tax And Registration Guide Peo Guide

Who Is Exempt From Oregon Wbf Tax

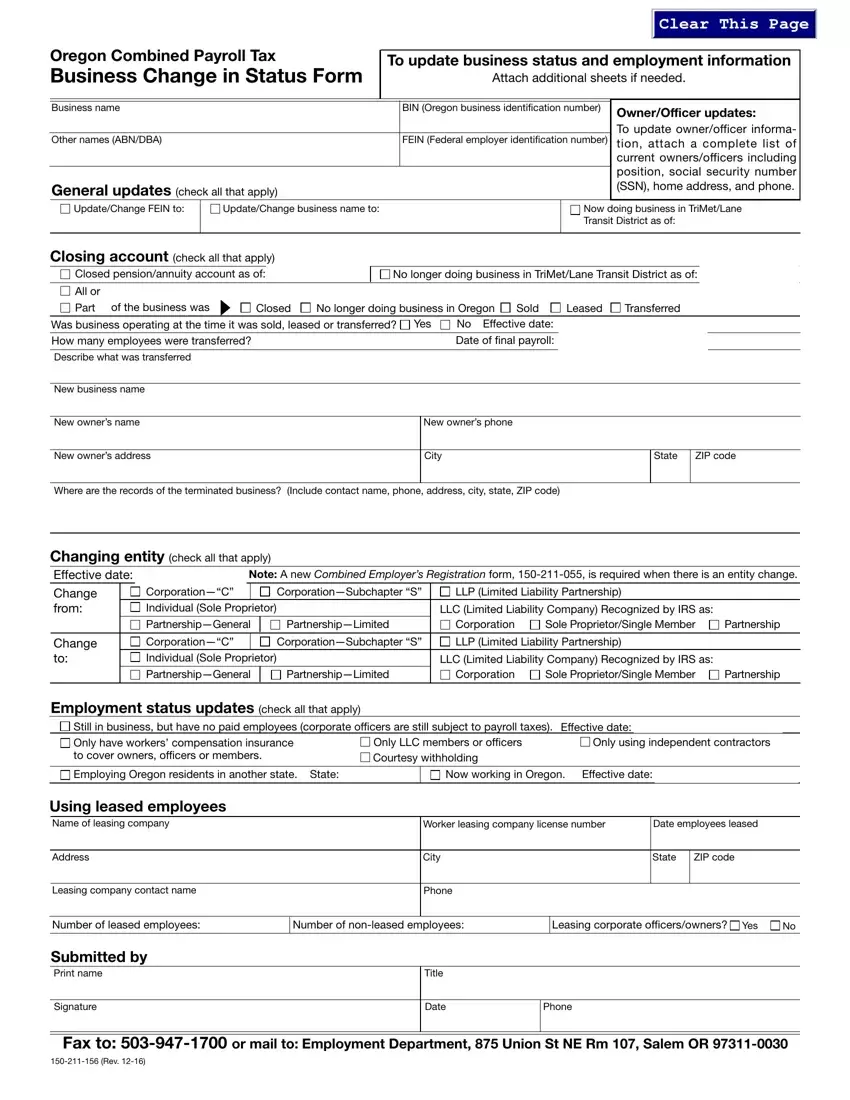

Bin Oregon Fill Out Printable Pdf Forms Online

Oregon Payroll Tax And Registration Guide Peo Guide

Manual For The State Of Oregon

Bin Oregon Fill Out Printable Pdf Forms Online

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

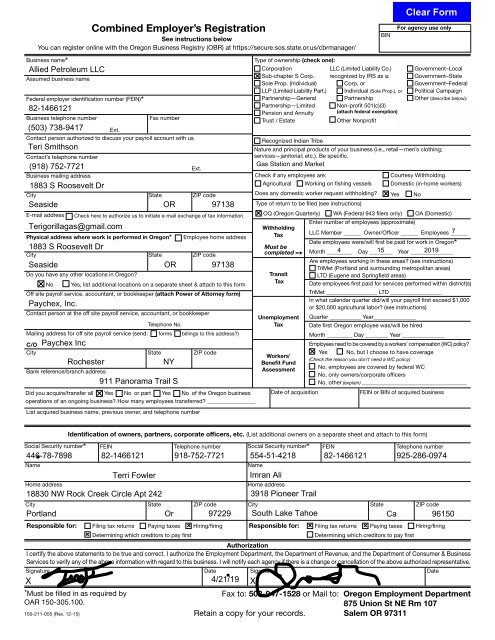

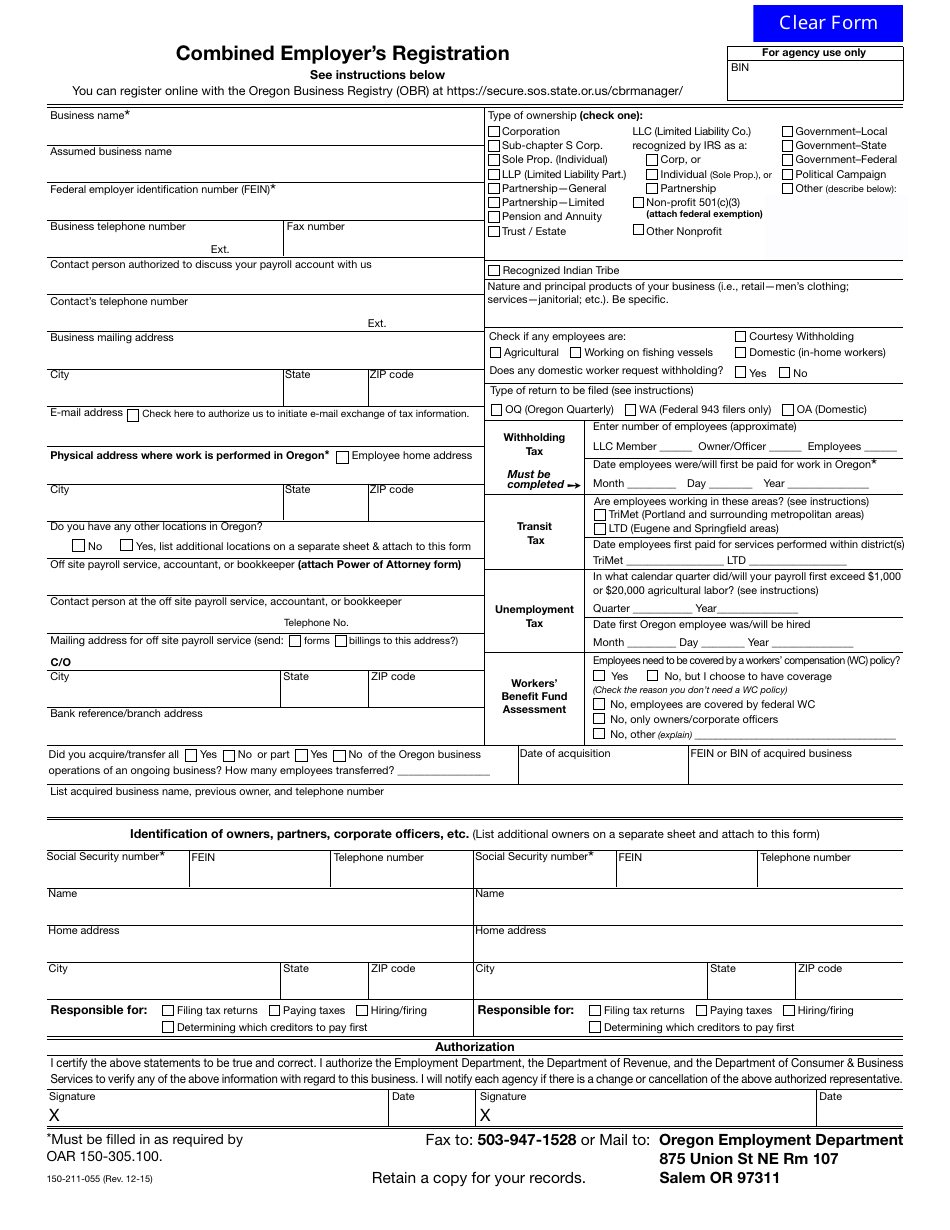

Form 150 211 055 Download Fillable Pdf Or Fill Online Combined Employer S Registration Oregon Templateroller

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download